Taxes & Spending

Congress needs to manage their spending just like many hard-working, honest families and businesses back in Michigan who work every day towards maintaining their responsible bottom lines. Congress must be judicious in decisions to spend and ensure that appropriated dollars are used efficiently.

Reduce Tax Burden

For too long, Americans were subject to a complex, burdensome tax code that held back job creation and harmed Michigan families. The Tax Cuts and Jobs Act of 2017, which I supported, implemented the first major overhaul of the tax code in more than 30 years and delivered historic tax relief for workers, families and job creators in Michigan.

In July 2025, I voted in favor of the Working Families Tax Cuts legislation, which was signed into law by President Trump on our nation’s 249th birthday. This historic legislation permanently extends the 2017 tax cuts and prevents residents of Michigan’s 5th Congressional District from seeing a 27% tax hike. If not for the Working Families Tax Cuts, a family of 4 making $65,437, the median income of MI-05, would see a $1,240 tax increase, which equates to about 6 weeks' worth of groceries. Other key provisions include no tax on tips, no tax on overtime, and slashing taxes on seniors’ Social Security benefits.

The legislation also delivers the largest deficit reduction in nearly 30 years, with $1.5 trillion in mandatory savings, and will increase take-home pay for a typical family of 4 in Michigan by up to $11,700. Click here to read more about this generational opportunity for hardworking Americans.

Combat Inflation

Following the Biden administration’s reckless spending which caused rampant inflation, we need to stop with the big-government, runaway spending coming from Washington. I opposed the inflationary American Rescue Plan and the misleadingly named “Inflation Reduction Act”. It is imperative that Congress refocus its attention upon inflation and growing jobs for hard-working families. I have supported efforts to prevent legislation estimated to increase inflation, until the year-over-year inflation rate is under a specified percent.

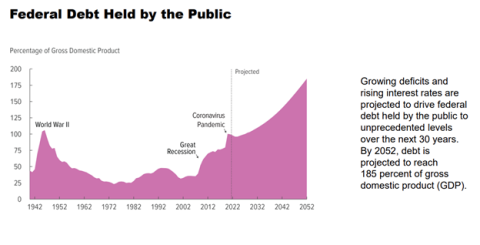

Balance the Budget

I have also supported an amendment to the Constitution that requires Congress not spend more than it receives in revenues, requires a 3/5 majority vote to increase the debt limit and requires the President to submit a balanced budget to Congress.

Get Rid of Government Waste, Increase Transparency

Congress needs to do a better job of identifying and stopping funding for ineffective programs that have lost their intended purpose or impact. In particular, I championed the bipartisan Taxpayers Right-To-Know Act, which mandated the creation of an online inventory of each federal agency’s programs, as well as provide basic information on what the program does and how much they cost. The Taxpayers Right-To-Know Act was signed into law in 2021.

Additionally, I have spearheaded efforts to cut government waste in federal grant making. The Grants Oversight and New Efficiency (GONE) Act requires federal agencies to take action to identify and close out thousands of expired grant accounts with a zero balance - an action which could save the government millions each year. The GONE Act was signed into law in 2016.

Line-Item Veto

We need to give the President the authority to single out wasteful spending items in legislation and send these specific line-items back to Congress for an up-or-down vote on whether to drop funding for these items.

Related Items

07/03/2025 - Chairman Walberg Delivers Remarks in Support of the One Big, Beautiful Bill

08/12/2022 - Walberg: Democrats’ Tax and Spending Spree Will Hurt Michigan Families

11/19/2021 - Walberg: Pelosi’s Tax and Spending Spree is Too Costly and Extreme

02/27/2021 - Walberg Opposes Pelosi’s $1.9 Trillion Spending Bill

Legislation

Signed into Law: H.R. 3830, Taxpayers Right-To-Know Act

Sponsored Legislation: H.R. 2266, COLA Act

Sponsored Legislation: H.R. 1221, Social Security and Medicare Lock-Box Act

Cosponsored Legislation: H.R. 1776, Regulations for the Executive in Need of Scrutiny Act

Cosponsored Legislation: H.R. 1301, Death Tax Repeal Act

Cosponsored Legislation: H.R. 25, Fair Tax Act

Cosponsored Legislation: H.J.Res.3, Proposing a Balanced Budget Amendment to the Constitution of the United States.

Cosponsored Legislation: - H.R.8369, To require the Executive Office of the President to provide an inflation estimate with respect to executive orders with a significant effect on the annual gross budget, and for other purposes.

Cosponsored Legislation: H.R.6733, Ban IRS Biometric Act

Cosponsored Legislation: H.R.6658, Protecting Family and Small Business Tax Cuts Act

Cosponsored Legislation: H.R.6485, Inflation Prevention Act

Cosponsored Legislation: H.R. 5586, Prohibiting IRS Financial Surveillance Act

Cosponsored Legislation: H.R. 2002, Let States Cut Taxes Act

Cosponsored Legislation: H.R.8703, REVIEW Act