The One Big, Beautiful Bill - Historic Working Families Tax Cuts

For far too long, our nation has dealt with reckless spending that has driven the United States into a fiscal crisis. The federal government currently has over $36 trillion in debt, with debt continuing to accrue each day. President Trump and Republicans in Congress stood united to pass the Working Families Tax Cuts legislation to take advantage of a generational opportunity to restore fiscal sanity, invest in our communities, and usher in a new Golden Age in America. This historic legislation was signed into law by President Trump on America’s 249th birthday.

Preventing the Largest Tax Hike on Americans in History

A cornerstone of the legislation is the permanent expansion of the Tax Cuts and Jobs Act (TCJA) of 2017. The TCJA supported hardworking families and our economy. Only two years after being signed into law, real median household income increased by $5,000 and real wages rose by 4.9%, allowing families to pocket more of their hard-earned money. Without the Working Families Tax Cuts, these vital tax cuts will expire, resulting in historic tax increases on small businesses and working-class families. The provisions included in the package will deliver the largest tax cut in American history, with working families making between $15,000 and $30,000 seeing their taxes be cut by 21%, the largest of any income group.

Impact on MI-05 Residents by the Numbers

Michigan's 5th Congressional District is home to 416,620 taxpayers. If the Trump tax cuts expire, the average taxpayer in the district would see a 27% tax hike. This means that a family of 4 making $65,437, the median income of MI-05, would see a $1,240 tax increase, which equates to about 6 weeks' worth of groceries. Below are some of the other detrimental effects of expiration:

- 66,780 MI-05 families would see their household’s Child Tax Credit cut in half

- 95% of MI-05 taxpayers would see their Guaranteed Deduction slashed in half

- 33,380 Small Businesses in MI-05 would be hit with a 43.4% tax rate if the 199A Small Business Deduction expires

- 19,238 MI-05 taxpayers would be impacted by the return of the Alternative Minimum Tax

- 7,891 Family-Owned Farms in MI-05 would have their Death Tax Exemption slashed in half next year

Restoring Fiscal Responsibility

The $36 trillion national debt crisis in Washington must be solved by advancing pro-growth policies and taking bold steps toward fiscal responsibility. The Working Families Tax Cuts will reverse the spending crisis in Washington, D.C. The bill delivers the largest deficit reduction in nearly 30 years, with $1.5 trillion in savings.

Helping Students

Under my leadership as Chair, the Education and Workforce Committee advanced the Student Success and Taxpayer Savings Plan, which is estimated to produce over $280 billion in savings while bringing much-needed reform by simplifying loan repayment and streamlining student loan options. Together, these reforms will provide economic mobility for our students and families. The legislation also expands Pell Grant eligibility to individuals who are enrolling in high-quality, short-term career programs. This will provide equal opportunities for students and workers to gain skills in high-demand fields as those enrolling in a four-year degree program. No other piece of enacted legislation in recent congressional history has saved as much as the Student Success and Taxpayer Savings Plan would.

Supporting Families

In addition to lower taxes for families, the Working Families Tax Cuts legislation contains other pro-family provisions like increasing the child tax credit, establishing accounts for newborns to start saving, and strengthening paid family leave. Seniors will also receive historic tax relief, as the bill slashes taxes on seniors' Social Security benefits. Under the legislation, 88% of all seniors who receive Social Security will see their tax deductions exceed their taxable Social Security income, meaning they will no longer be paying federal income taxes on their Social Security benefits.

Supporting Workers

After experiencing runaway inflation year after year, Americans deserve relief and policies that will allow them to keep more of their hard-earned dollars. The Working Families Tax Cuts legislation includes many provisions that will deliver on the commitment made to American workers, revitalize our economy, and prevent an estimated 6 million jobs from being lost from the expiration of the TCJA. Key policies include:

- No Tax on Tips

- No Tax on Overtime

- Repealing the requirement that Venmo, PayPal, and other gig transactions over $6,000 be reported to the IRS

No Tax on Tips and Overtime will be retroactive for 2025. For the 2025 tax year, the deduction will be realized when filing your tax return.

The Council on Economic Advisors has also estimated that the legislation will increase take-home pay for a typical family of 4 in Michigan by up to $11,700.

Strengthening our Economy

Over the past few decades, we’ve seen the offshoring of businesses, including manufacturing. The Working Families Tax Cuts legislation will fuel significant economic growth and bring manufacturing back to the U.S. The bill incentivizes Made-in-America by rewarding new factories built in the U.S. and lowering the tax rate for those building their products in the U.S. It also allows Americans who buy an American-made vehicle to fully deduct their auto loan interest. In total, the Working Families Tax Cuts legislation is estimated to increase real economic growth by up to 4.9% and save or create up to 7.2 million full-time American jobs in the next four years.

Empowering Small Businesses

I’ve heard from small businesses in Michigan and across the country about the need for tax relief after the policies of the previous administration. By making the 20% small business deduction from the TCJA permanent, small businesses will create 1 million new jobs and $75 billion in economic growth every year. Extending the tax cuts will allow small businesses to reinvest in their employees, innovation, and their communities. It will also allow for business expansion, create more good-paying jobs, and grow our economy.

Supporting Farmers

The TCJA contained many important tax provisions for farmers, including doubling the Death Tax exemption and indexing it for inflation each year to protect family farms from the Death Tax’s 40% rate. We have expanded these critical benefits to provide stability and security for America’s farmers. The legislation protects family farmers by preventing the death tax from hitting two million family-owned farms that would otherwise see their exemptions cut in half. It would also cut taxes on farmers by over $10 billion.

Securing our Borders

The package would also secure our borders by making the largest border security investment in history. It funds the construction of the border wall to prevent deadly fentanyl from flowing into our communities and prevent illegal border crossings. It also will help immigration authorities to carry out their mission by hiring 10,000 new ICE personnel, 5,000 new customs officers, and 3,000 new Border Patrol agents. In addition, the bill will empower those on the frontline by providing $10,000 bonuses in each of the next four years to these agents.

Revolutionizing our National Security

The Working Families Tax Cuts legislation ensures our country’s weaponry and defense systems are modernized to protect our homeland against 21st-century threats. This bill is a once-in-a-generation opportunity to revolutionize our nation’s defense capabilities with historic investments in cutting-edge technologies and ensure our military is equipped to protect our country against any threats. Key policies include:

- Securing President Trump’s Golden Dome missile defense shield to protect American families in the 21st century

- Modernizing air traffic control to ensure Americans fly safely and efficiently

- Restoring maritime dominance with critical investments in American shipbuilding that will advance the capabilities of our naval fleet

- Modernizing the Coast Guard, upgrading ships, planes, icebreakers, and facilities to keep our homeland safe

Unleashing American Energy Dominance

The Working Families Tax Cuts legislation includes many provisions that will unleash American energy production to unlock our full energy potential and bring down costs for American families. The bill will increase onshore and offshore oil and gas leases to provide certainty for energy producers, spur job growth, and make energy more affordable for American consumers. The bill also increases the mining of domestic minerals and makes America less dependent on foreign adversaries for critical minerals. Moreover, provisions in the package would reverse anti-energy policies that led to skyrocketing energy costs by repealing or phasing out green corporate welfare subsidies found in Democrats’ so-called “Inflation Reduction Act,” stopping credits from flowing to China to save taxpayers over $500 billion every year, and reversing electric vehicle mandates that restrict consumer choice.

Investing in Rural Healthcare

House Republicans’ Working Families Tax Cuts legislation included the single largest investment in rural healthcare in U.S. history. The $50 billion Rural Health Transformation Fund will support rural healthcare by promoting increased workforce resiliency and access to care. Funding will be allocated directly to states that apply for the program, who will then distribute funding to rural healthcare providers. By investing in rural communities, we can make our health care system work more efficiently and ensure the long-term sustainability of our rural providers for years to come. For more information on the program and the application process, please click here.

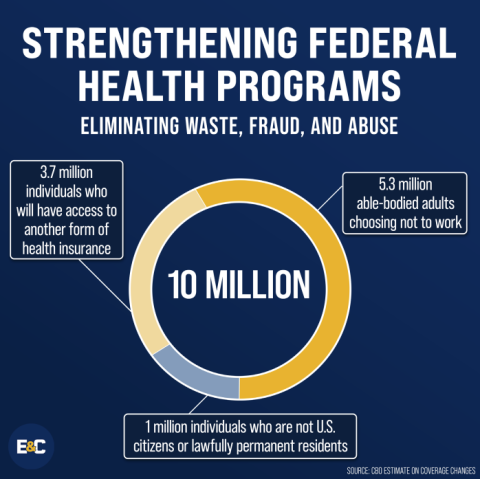

Strengthening and Securing Medicaid

The legislation strengthens Medicaid so it can continue serving the most vulnerable Americans it was intended to serve—namely, pregnant women, children, those living with disabilities, and seniors. As seen in the graphic below, the legislation will end benefits for illegal immigrants who are gaming the system and requires able-bodied Americans to work if they receive benefits. These actions will protect Medicaid from the current waste, fraud, and abuse in the program so that we can secure and sustain the program for those it was intended to serve for generations to come.

Resources on the Working Families Tax Cuts

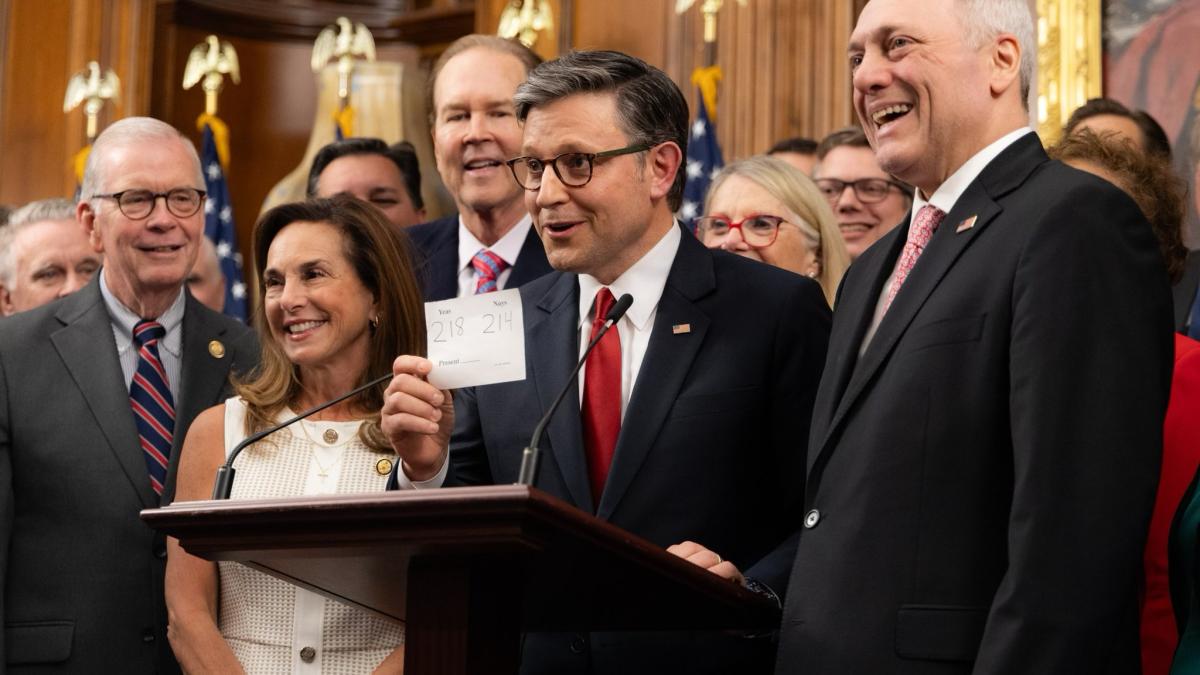

Chairman Walberg Delivers Remarks in Support of the One Big, Beautiful Bill

Chairman Walberg Speaks at Press Conference Praising House Passage of One Big, Beautiful Bill

20 Reasons Why Congress Must Unite Behind the One, Big, Beautiful Bill

Myth vs. Fact: The One Big Beautiful Bill

Council of Economic Advisors Full Report